Applying for a loan in the United States is easier than ever, thanks to online lenders, banks, and financial institutions offering fast and transparent processes. Whether you need a personal loan, home loan, auto loan, or business loan, understanding the steps can help you get approved faster and at better rates.

Types of Loans Available in the USA

Before applying, it’s important to know which loan fits your needs:

-

Personal Loans – For medical expenses, travel, debt consolidation, or emergencies

-

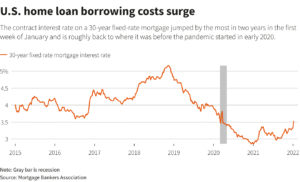

Home Loans (Mortgages) – To buy, build, or refinance a home

-

Auto Loans – For new or used vehicles

-

Business Loans – To start or expand a business

-

Student Loans – For education and tuition costs

Each loan type has different eligibility criteria, interest rates, and repayment terms.

Eligibility Criteria for Loan Application

Most lenders in the USA consider the following factors:

-

Credit Score (usually 620+ for better approval chances)

-

Stable Income or Employment

-

Age (18 years or older)

-

US Citizenship or Legal Residency

-

Debt-to-Income Ratio (DTI)

A higher credit score generally means lower interest rates and better loan terms.

Documents Required to Apply for a Loan

Keep these documents ready to speed up the process:

-

Government-issued ID (Passport or Driver’s License)

-

Social Security Number (SSN)

-

Proof of Income (Pay stubs, tax returns, or bank statements)

-

Employment details

-

Address proof

For business or home loans, additional documents may be required.

Step-by-Step Process to Apply for a Loan in the USA

1. Check Your Credit Score

Review your credit report before applying. Fix any errors to improve approval chances.

2. Compare Lenders

Compare banks, credit unions, and online lenders based on:

-

Interest rates

-

Loan tenure

-

Processing fees

-

Customer reviews

3. Choose the Right Loan Amount

Borrow only what you need to keep monthly payments manageable.

4. Submit the Application

Most lenders allow online applications with instant pre-approval.

5. Verification & Approval

The lender verifies your documents and credit details.

6. Loan Disbursement

Once approved, funds are transferred to your bank account—sometimes within 24–48 hours.

Tips to Get Loan Approval Faster

-

Maintain a good credit score

-

Reduce existing debts

-

Apply with a co-signer if needed

-

Avoid multiple loan applications at once

-

Choose realistic repayment terms

Benefits of Applying for a Loan Online

-

Fast approval

-

Easy comparison of lenders

-

Minimal paperwork

-

Transparent terms

-

Secure digital process

Final Thoughts

Applying for a loan in the USA is a straightforward process if you plan ahead. By checking your eligibility, preparing documents, and comparing lenders, you can secure the best loan with affordable interest rates. Always read the terms carefully and borrow responsibly.

If you’re planning to apply for a loan, start by comparing trusted lenders online and take the first step toward achieving your financial goals.