A personal loan in the USA is one of the most flexible financial products available to individuals. It can be used for almost any purpose, including medical expenses, travel, home renovation, debt consolidation, education, or emergency needs. Unlike auto or home loans, personal loans are usually unsecured, meaning no collateral is required.

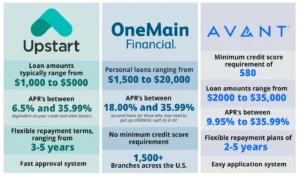

Personal loans are offered by banks, credit unions, and online lenders across the United States. Because of high competition among lenders, borrowers can often find attractive interest rates, flexible repayment terms, and fast approval processes, especially when applying online.

One of the biggest advantages of a personal loan is simplicity. You receive a lump sum amount upfront and repay it in fixed monthly installments over a predefined period. This predictable structure makes budgeting easier for borrowers.

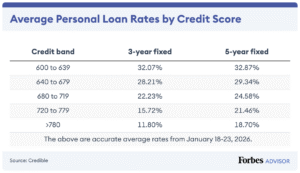

Before applying, it is important to understand who is eligible for a personal loan in the USA. Lenders generally evaluate your credit score, income stability, employment history, and existing debt. A higher credit score increases approval chances and helps secure lower interest rates.

Most lenders require applicants to be at least 18 years old and either US citizens or legal residents. Proof of income, valid identification, and a Social Security Number (SSN) are commonly required documents during the application process.

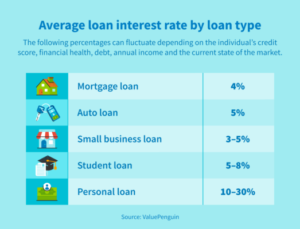

Personal loan interest rates in the USA vary widely based on credit profile and lender type. Borrowers with excellent credit receive the lowest rates, while those with poor or limited credit may face higher rates.

Typical personal loan interest rate ranges include:

-

Excellent credit: 6% – 10% APR

-

Good credit: 10% – 18% APR

-

Fair credit: 18% – 28% APR

-

Poor credit: 28% – 36% APR

These rates can be fixed or variable, though most personal loans offer fixed interest rates for stable monthly payments.

Loan amounts usually range from $1,000 to $50,000, though some lenders may offer higher limits to borrowers with strong credit and income. The approved amount depends on your financial profile and ability to repay.

Another important factor is loan tenure, also known as the repayment period. In the USA, personal loan terms typically range from 2 to 7 years. Shorter tenures have higher monthly payments but lower total interest costs, while longer tenures reduce monthly burden but increase total interest paid.

Personal loans also come with fees that borrowers should understand clearly before signing any agreement. These fees can significantly affect the overall cost of the loan.

Common personal loan fees in the USA include:

-

Origination fee (1% – 8% of loan amount)

-

Late payment fee

-

Returned payment fee

-

Prepayment fee (rare but possible)

Some lenders advertise “no-fee” personal loans, but borrowers should always read the fine print to confirm.

One popular use of personal loans is debt consolidation. Borrowers combine multiple high-interest debts, such as credit cards, into a single personal loan with a lower interest rate. This simplifies payments and can reduce overall interest costs.

Personal loans are also commonly used for medical expenses, especially when insurance does not fully cover treatment. Fixed repayment schedules help patients manage healthcare costs without relying on high-interest credit cards.

The application process for a personal loan in the USA is usually straightforward. Many lenders offer online applications with instant pre-qualification, which allows borrowers to check estimated rates without affecting their credit score.

After submitting a full application, lenders verify documents, review credit history, and assess risk. Approval can take anywhere from a few minutes to a few days, depending on the lender and loan complexity.

Once approved, funds are typically disbursed directly into the borrower’s bank account. Some lenders provide same-day or next-day funding, making personal loans ideal for urgent financial needs.

Another benefit of personal loans is credit building. Making timely monthly payments can improve your credit score over time, which helps with future borrowing opportunities such as mortgages or auto loans.

However, borrowers should also be aware of the risks. Missing payments can damage credit scores and lead to late fees or collections. It is essential to borrow only what you can comfortably repay.

Comparing multiple lenders is one of the smartest steps before taking a personal loan. Comparing APR, fees, repayment terms, and customer reviews helps ensure you get the best deal for your financial situation.

Many lenders also offer discounts for setting up automatic payments or having an existing banking relationship. These small benefits can reduce interest rates slightly and save money over time.

Personal loans are available for both employed individuals and self-employed professionals. Freelancers and business owners may need to provide additional income documentation, such as tax returns or bank statements.

In today’s digital environment, personal loans have become more accessible than ever. Online platforms provide transparency, quick approvals, and flexible options, making borrowing easier for millions of Americans.

In conclusion, a personal loan in the USA is a powerful financial tool when used responsibly. By understanding interest rates, fees, eligibility, and repayment terms, borrowers can make informed decisions, manage expenses effectively, and achieve financial stability without unnecessary stress.